6 Real-Life Ways Advocacy Simplifies Healthcare

What kind of experience do your clients have when they engage the healthcare system? Employers usually hear stories that sound something like this recent LinkedIn post….

Now consider that this quote was from an educated, experienced benefits advisor…UGH!

We’re past the days when your clients can thrive with just an insurance plan. 93% of employees don’t believe the health plan is looking out for their best interests. Hence, people are confused on how to get the most out of their benefits and the healthcare system.

As a broker, you likely used to make it part of your “client service program” to answer people’s questions and issues, but the sheer volume and complexity of those issues have skyrocketed in recent years. Unless you’re prepared to answer hundreds more issues this year (and the next), you aren’t staffed to handle it.

I’m sharing 6 real-life ways a premium Advocacy program will help your clients cut healthcare costs and confusion…

1. Understand health benefits & plans

This is a particularly huge win if you install advocacy prior to open enrollment. After you load current and upcoming plan details into your client profiles, the Advocate can take the lion’s-share of the calls from members trying to understand upcoming changes in benefits. This is a huge help for brokers who have most clients renewing on a calendar-year basis, saving you and your staff from hundreds (or thousands?) of detailed conversations. And, it gives employees an educated advisor to help them weigh all the options. For more details, click here for an in-depth case study.

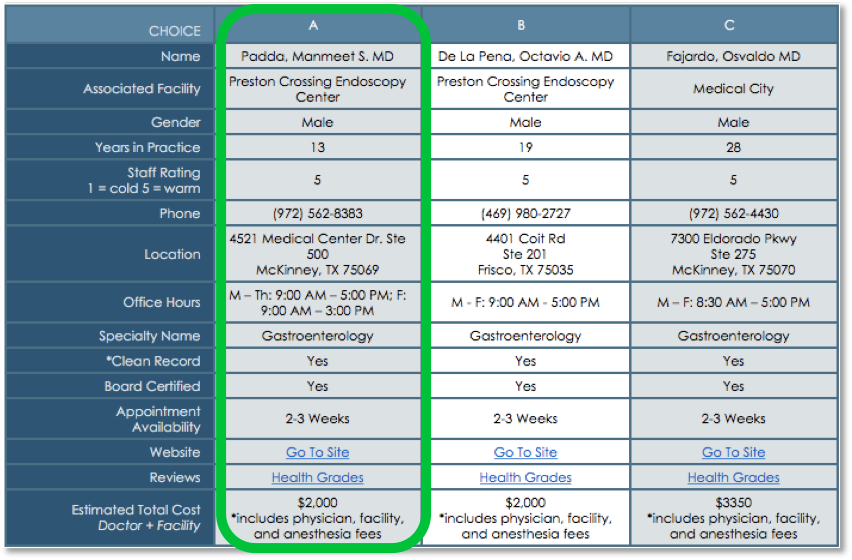

2. Find highly rated, cost-effective providers

All providers in a network are not the same. Some are just better. The carrier’s customer service reps will never discuss quality differences between providers. An independent Advocate knows the employee’s plan and network. They cross-reference it with their national database – packed with data from hundreds of thousands of personal calls to providers every year. Add in the member’s provider preferences – younger/older, female/male, location, specialty – and they have an amazing process to locate just the right provider for each employee.

In the end, employees receive the Advocate’s best three provider recommendations: the highest-rated, the soonest-available, and the lowest-cost. That’s definitely better than asking your friends on Facebook for a recommendation!

3. Coordinate care

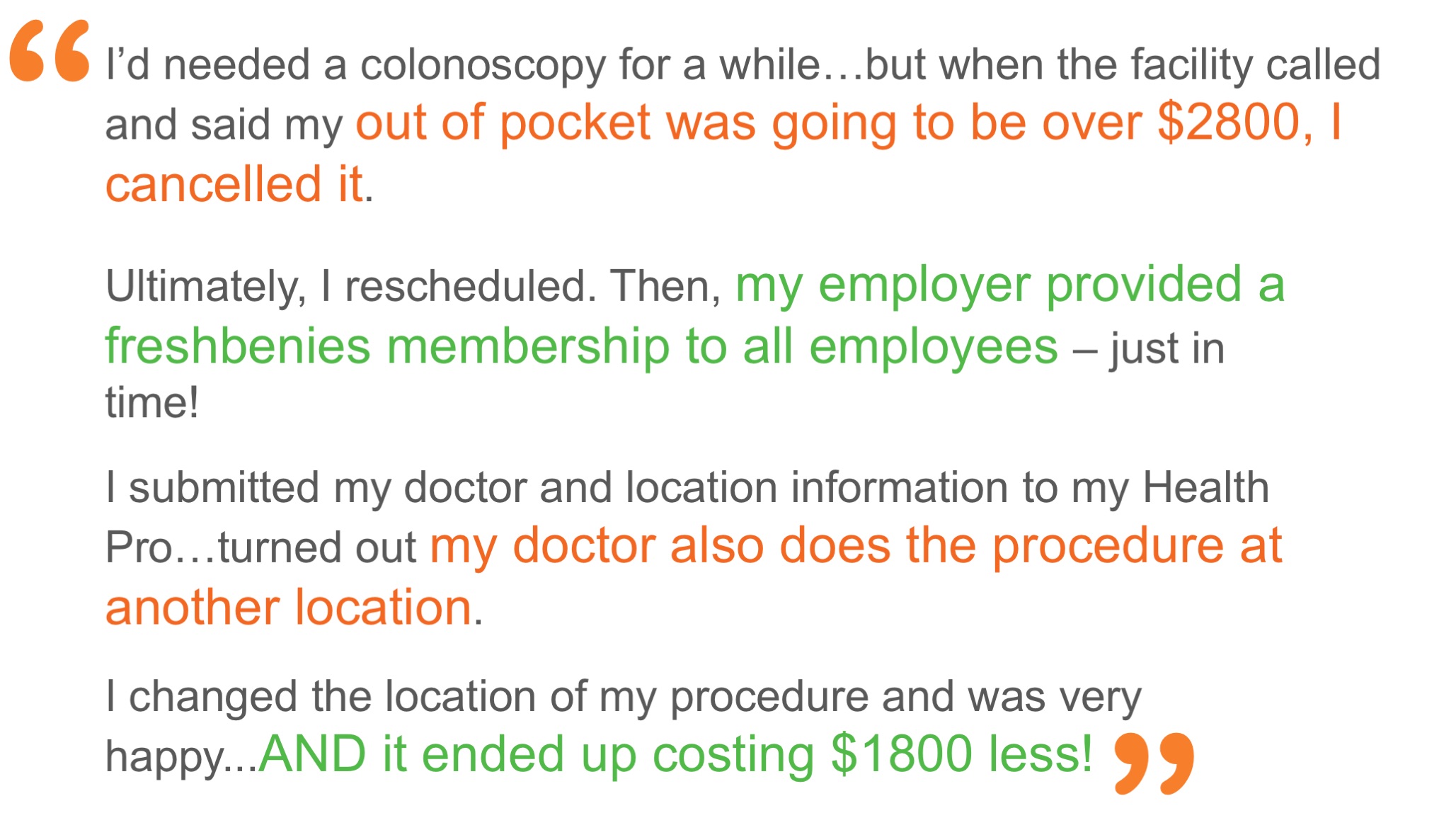

One of the most complicated times for employees engaging the healthcare system is planning a set of services amongst doctors, hospitals, surgeons, labs, anesthesiologists, etc. Advocates can be the educated navigator through this maze to find the best-caliber locations – including the “money talk.” For example, here’s a client kudo after utilizing the service for this type of help…

4. Compare cost and quality for medical procedures

Nobody wants to be told to get the cheapest medical care. Rather, encourage employees to check with their advocate to help them find the best quality care. Then, during the conversation, the member can be guided through understanding the full value equation of price and quality.

See the following report produced by an Advocate in response to a request for a local Gastroenterologist and a colonoscopy. Notice the level of detail, personalization and specificity.

5. Drive lower-cost Rx

With all the different Rx plan designs, there’s not a single, simple way to solve for it - which makes it tough to educate employees to achieve the best savings. This is precisely why Rx is a separate section on this list. Teach your clients to contact their Advocate to help sort through alternatives. They’ll personalize the answer – whether that means a savings network, coupon program, a smart selection of formulary vs. non-formulary drugs, an alternative medication, etc. Then you’ll get testimonials like this…

6. Help with medical bills

Ever hear a client say they got a surprise bill after a surgery? Of course you have – you may even be that person!

If you’re like me, you don’t believe Washington’s claim that they’ve “solved surprise billing” – and it’s not really going to have an impact on your clients anytime soon.

Help with medical bills is one of the most-used Advocacy services. There are two ways it empowers employees:

- Fix Billing Errors – 30% (and more) of medical bills have errors. Advocates will review and research bills, plus do the outreach to fix those errors. The result is sometimes savings to the member, and sometimes to the plan (when beyond the out-of-pocket maximum).

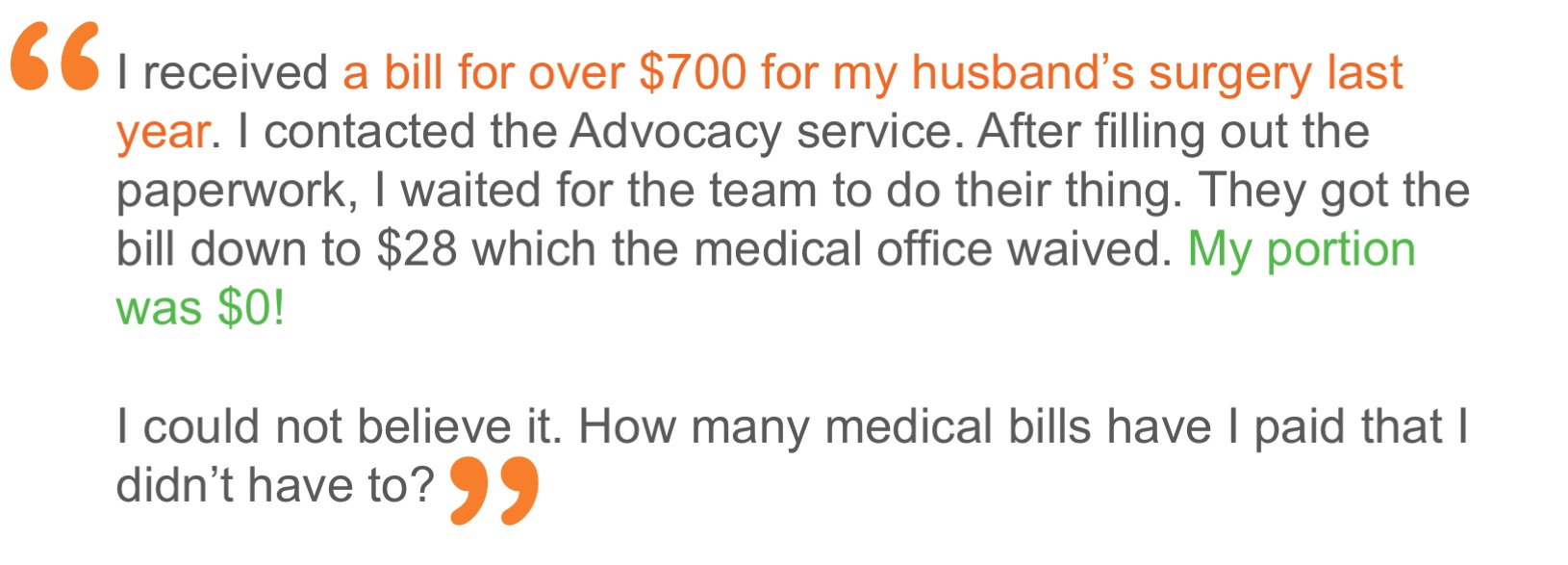

- Negotiate Out-Of-Network Claims – Who goes to bat for the member when a claim is out of network? Let the Advocate do this. They’re trained to know the levers to pull during this type of negotiation. They can’t always negotiate down from the billed amount, but when they do, the results can be huge…

Additional Resources

If you haven’t seen a premium advocacy program at work, it’s easy to think that your account manager and the carrier’s customer service department can address everything members need. And if you’ve used a standard-level advocacy service, you’ve seen they’re okay, but there are many scenarios they can’t solve.

In today’s benefits market, these 6 Advocacy services truly are a game-changing win for the employee, the employer and you – the benefits advisor. But they can only help your clients that have the service, so start including it with every prospect and every renewal. You’ll be the hero to your HR Directors.

Download this Advocacy Infographic to spark conversation with a prospect or existing employer. Click the image below..

Now it’s your turn! What’s your experience with premium advocacy services? Are there groups you believe won’t see value from a similar strategy? Comment below to tell me your story or email me at reid@freshbenies.com.